Home buying much cheaper than renting

By Les Christie @CNNMoney March 21, 2012: 8:22 AM ET

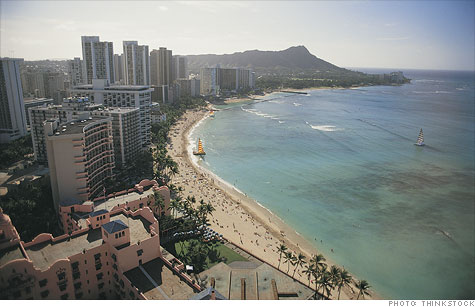

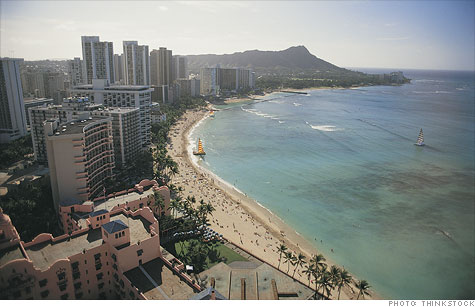

Honolulu is the nation's best market to be a renter rather than a buyer.

NEW YORK (CNNMoney) -- It's the eternal question in real estate: Should I buy or rent?

The answer has never been clearer: Buy.

In 98 of the top 100 housing markets, buying a home is more affordable than renting, according to the online real estate company Trulia. Only

Honolulu and

San Francisco buck the trend. There are several reasons.

Home prices are falling. Mortgage interest rates are at historically low levels. And rents are on the rise. Of course, many renters are not in a position to buy. For one, it's hard to get a mortgage these days, despite low rates. And paying rent can push them further away from being able to afford to buy. "Rising rents make it harder for people to save for a down payment, which is the biggest barrier to buying a home that aspiring homeowners face," Jed Kolko, Trulia's chief economist.

Click here for full article

Honolulu is the nation's best market to be a renter rather than a buyer.

Honolulu is the nation's best market to be a renter rather than a buyer. When remodeling, create a financial plan upfront and contractors can tailor proposals to fit what you can afford.

When remodeling, create a financial plan upfront and contractors can tailor proposals to fit what you can afford.